Latest Posts

Your money should work for you.

Get the latest tips on how to plan for retirement and make better financial decisions.

Don't worry... we will NOT spam you!

As a millennial, you know all too well that "adulting" can be difficult. That means accomplishing everything from landing a full-time job, making those student loan payments to smaller things, like actually remembering to floss every day. Something that is just as important, but often falls by the wayside: insurance. There's no doubt that, as a whole, this is a confusing topic, but it doesn't have to be. Below, we walk you through the basic questions to ask and actions to take when determining your insurance needs for today and the future. Starting out is really the toughest part. What type of insurance do I need? How much does it cost? How do I choose the best option? The process can feel like a war between your wallet and brain, but when an accident occurs or emergency happens having an insurance safety net will allow your pocket and mind to rest easy.

Stretch your budget wisely by choosing the appropriate insurance, here are the five basic policies you should be concerned with as a millennial:

Health Insurance

Do you how much your health actually costs? According to the National Coalition of Millennial Health, collectively millennials will spend $174 billion on health expenses every year. It’s not a surprising price tag when you consider health your greatest asset, but something that is astonishing is the amount of confusion surrounding health care. The problem is the system changes and therefore what was the best option one year may not be available the next. If you’re unsure of your health care possibilities begin first with understanding your individual health. The right coverage for you might not be the best for other millennials. Once you have an idea of what you want from your coverage look into these four primary coverage options: individual private plan, Medicaid, employment-based, or catastrophic insurance. Each choice is targeted to different needs, for example, Medicaid is only offered to those who earn less than $16,500, while an employment-based plan is flexible within the company you work for. Millennials who are still under 26, know that you can stay on your parent's plan to save money. You can be on their plan even if you’re married, living on your own, or living in another state.

Disability Insurance

If you’re unable to work for the next three months or five years could you survive on your savings alone? This is where disability insurance can be your saving grace. There are two basic options for disability: short-term (covers three to six months) and long-term (covers until you return to work or the number of years stated in your policy). Many employers offer short-term coverage, but it’s up to the individual to determine if long-term coverage is necessary. Long-term disability insurance makes more sense for certain jobs. For instance, if you're a nurse in a hospital and you break your leg, it's doubtful that you will be returning to work until that injury is headed, whereas if your work is mostly done from a desk or computer, you probably won't be out of commission for as long. The benefits to having both coverage plans are the long-term won’t kick in until after the short-term disability ends and it will extend the amount of time your income is protected. Disability is never something you think you need when you're young and invincible, but it's a vital insurance necessity. Think of it this way: while you're disabled you're still spending money with or without a paycheck. Policies for disability insurance vary depending on your age, occupation, and other contingencies. You can learn more about the different options for short or long-term disability with these disability insurance basics.

Homeowners & Renters Insurance

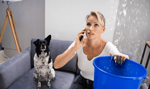

Do you believe home is where the heart is? As a millennial, chances are you're either planning to move out soon or you've already made the big step, but what about homeowner and renters insurance? When you purchase a home the mortgage will come with homeowners insurance (it's actually a law). However, renters insurance is voluntary and commonly overlooked. You will want to purchase renters coverage as soon as you can, in case your home is robbed, catches on fire, or gets damaged in a natural disaster. The actual price will vary depending on the state you live in, but the average renter's insurance costs $187 annually in the United States while homeowners insurance is higher at $952 per year.

Auto Insurance

Have you ever been in an automotive accident? Considering that the AAA Foundation for Traffic Safety releases a report stating, drivers ages 19-24 were 1.6 times more likely than all other drivers to read a text or email when driving, and almost twice as likely to type or send a text or email while driving, the probability of a millennial needing auto coverage is pretty good. Not to mention if you own a car you MUST purchase auto insurance to drive legally in the United States. The actual amount of coverage required varies from state to state, and you should start by checking out your minimum car insurance requirements. Honestly, though for most people, the minimum is not going to be enough, especially if you get into an accident with multiple vehicles or an uninsured motorist. Do some window shopping before choosing an auto insurance provider and get the amount of coverage that's necessary. If you’re driving a BMW you won't need the same coverage as someone driving a minivan. Also for anyone with an accident-free record, keep an eye out for discounts for safe drivers, and as soon as you have your first auto claim your rates will go up dramatically.

Life Insurance

If you passed away tomorrow would your loved ones be financially prepared to take on your debts? When a tragedy occurs the last thing a family should be worrying about is money, but with the average funeral costing between $7,000-$10,0000, chances are they will face some financial burdens. When you're young, life insurance is the last thing you're thinking about, but if you can swing it financially the perks of getting coverage now are greater than if you wait. By locking in your rates in your twenties, you'll pay less in the long term. You're able to score lower rates as a millennial because typically the cost is based on your overall health, age, height, weight, and smoking habits. Someone younger is less likely to need insurance and therefore can get a cheaper rate. Waiting until your thirties or forties you’ll see the monthly cost jump significantly. Also if you're married, or have kids and are struggling to pay off debts now, imagine how that will worsen when you're no longer able to contribute. Life insurance will help protect your family's financial picture.

It's easy to brush off insurance needs as a millennial, but having a plan now can help shelter not only your finances but your loved ones' finances too. An insurance professional or advisor can be a great tool to get you started in the process and there are bundling packages that can help reduce your insurance rates. As with all your financial decisions being informed and knowing your options will allow you to live a financially bright future.