For retirement plan employers, 401(k) nondiscrimination testing is one of the most critical functions of operating a healthy retirement plan—and it’s also an important mandate of ERISA. Here’s a look at some commonly asked questions and need-to-know terms and concepts, as well as how this important task affects your company’s retirement plan.

What Is Nondiscrimination Testing?

ERISA requires that retirement plans undergo annual calculations to ensure that they don’t disproportionately benefit a specific group of employees (i.e., highly compensated employees [HCEs]) and that employees haven’t exceeded IRS contribution limits. These calculations are referred to as nondiscrimination testing.

Is There a Deadline to Complete Nondiscrimination Testing?

Generally, the deadline is two-and-a-half months following the plan’s year-end (March 15 for calendar year plans).

Who Is Responsible for Performing Nondiscrimination Testing?

Your service provider (e.g., a third-party administrator or recordkeeper) will likely perform nondiscrimination testing as part of its contracted services. Although the test will be performed on your behalf, it is important to recognize that timely completion of the test is an employer’s fiduciary responsibility.

Who Is a Highly Compensated Employee/HCE (and Who Is Not)?

An HCE is classified as any employee who either:

-

- Owns more than 5 percent of the business at any time during the year for which the test is being conducted (Family members who own more than 5 percent of the business are attributed to own the same interest for purposes of nondiscrimination testing.), or

- Earned more than $135,000 in compensation in the previous year (For example, a test performed in 2023 will test for nondiscrimination in 2022. HCE compensation would be determined by “looking back” to 2022 compensation to determine HCE status. For tests performed in 2023 and looking back to 2022, the HCE compensation limit is $135,000.) This has significantly increased to $150,00 in 2023.

- Conversely, a non-HCE (NHCE) is any eligible employee who does not fit into one of the two categories above.

What Types of Nondiscrimination Testing Are There?

There are a few kinds of nondiscrimination tests to be aware of:

-

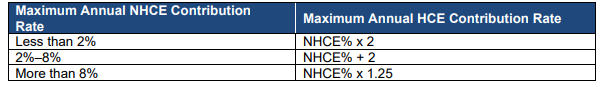

- The average deferral percentage (ADP) test. So long as they meet the eligibility requirements, HCEs may freely contribute to their retirement plan up to IRS-imposed limits (or plan-imposed limits, if applicable). So, the ADP test is applied to ensure that HCEs do not contribute proportionately more than the NHCEs. The ADP test measures the average salary deferral percentage (pretax and Roth, excluding catch-up contributions) of the HCE group against the average salary deferral of the NHCE group. To pass, the HCE average deferral percentage must not exceed the NHCE average deferral percentage by more than a certain amount, as is illustrated in the table below:

-

- The average contribution percentage (ACP) test. The ACP test compares the employer-matching contributions of HCEs with those of NHCEs. Also, if an employee (either an HCE or NHCE) contributes after-tax dollars, they would be factored into the ACP test. Once average rates are determined, the test is performed in the same manner as the ADP test.

What if the ADP or ACP test fails?

A failing test is corrected using one of two methods. The first (and most common) method is to refund excess contributions to HCEs in an amount that would lower the HCE average contribution percentage to a passing rate. The amounts are determined by a specific calculation and may or may not require each HCE to receive a refund. If a test fails and corrective action is required, timing is important. Corrective refund transactions must be completed within two-and-a-half months (March 15 for calendar-year plans) after the plan year. If they are not, a 10 percent excise tax (payable by the employer) may apply to the refunded amounts. Any pretax amounts refunded to an HCE would be taxable in the year in which they were distributed back to the HCE.

The second method is to make additional contributions to employee accounts in the NHCE group to the degree that it would raise the NHCE average contribution percentage rate to a passing level.

The top-heavy test. While both the ADP and ACP tests measure contribution averages, the top-heavy test measures the overall balances of two distinct groups: key employees and non-key employees. A key employee is someone who, at any point in the plan year, can be characterized in at least one of the following categories:

-

-

- An officer making over $215,000 for 2023 ($200,000 for 2022; $185,000 for 2021 and for 2020; $180,000 for 2019);

- An employee who owns more than 5 percent of the company (Family members who own more than 5 percent of the business are attributed to own the same interest for purposes of nondiscrimination testing.)

- An employee who owns more than 1 percent of the company (family attribution also applies) in the year for which the plan is being tested and received $150,000 or more in compensation

-

Once the key employees are identified, their balances are aggregated and compared with the aggregate balances of non-key employees. The balances of key employees cannot exceed 60 percent of the plan balance at the end of the plan year.

What if the top-heavy test fails?

Generally, to correct a top-heavy test failure, the employer must make a minimum nonelective contribution to non-key employees. Additional tests to consider:

-

-

- The coverage test. To comply with IRC 410(b), this nondiscrimination test ensures that enough NHCEs (70 percent at a minimum) are covered by the 401(k) plan, relative to the HCEs.

- The annual additions test. The IRS imposes limitations on contributions to a retirement plan in one year. The annual additions test aggregates all an employee’s contributions (both elective deferrals and employer contributions) to ensure that they don’t exceed the combined defined contribution limit ($66,000 in 2023; $61,000 in 2022) under IRC 415.

- The elective deferrals test. The elective deferrals test verifies that an employee does not exceed the statutory elective deferral limit ($22,500 for 2023; $20,500 for 2022) under IRC 402(g).

-

The Safe-Harbor Plan: A Cure for Testing Headaches?

What if your plan consistently fails nondiscrimination testing? Is there anything you can do? The answer is yes! A safe-harbor plan eliminates the need for nondiscrimination testing. To qualify for safe-harbor status, the employer must make a matching contribution. Options for doing so include:

-

-

- Basic safe-harbor match: The employer matches 100 percent of all employee contributions up to 3 percent of compensation, plus an additional match of 50 percent of their next 2 percent of compensation (for an effective 4 percent contribution).

- Enhanced match: A matching contribution must be as generous as the basic match at any level of employee deferral. A common option is for the employer to match at least 100 percent of all employee contributions, up to 4 percent of their compensation (not to exceed 6 percent of compensation).

- Safe-harbor nonelective contribution: The employer contributes 3 percent of each employee’s compensation, regardless of whether the employees defer.

-

Sometimes, however, a drastic shift in plan design is not what’s needed to lessen the gap between HCE and NHCE contribution rates. Consider tweaking your plan by adding auto-enrollment or auto-escalation features—both will help most employees defer a higher percentage of their salary, raising the collective average of their contribution rate. You’ll enjoy the benefits of improved worker morale, and your employees will take a positive step toward building their financial future.

Staying Ahead of the Game

Administering a retirement plan takes a significant amount of time, planning, and oversight. When it comes to nondiscrimination testing, some exceptions and nuances apply based on specialized scenarios beyond what is described above. So, where needed, tap into the expertise of service providers, such as your third-party administrator, recordkeeper, or plan advisor, for guidance. As your independent advisors we’re here to lead you through this process, so feel free to reach out to a member of our AFS with any questions or to learn more.