Personalizing Employee Benefits: The Key to a Quality Employee Experience

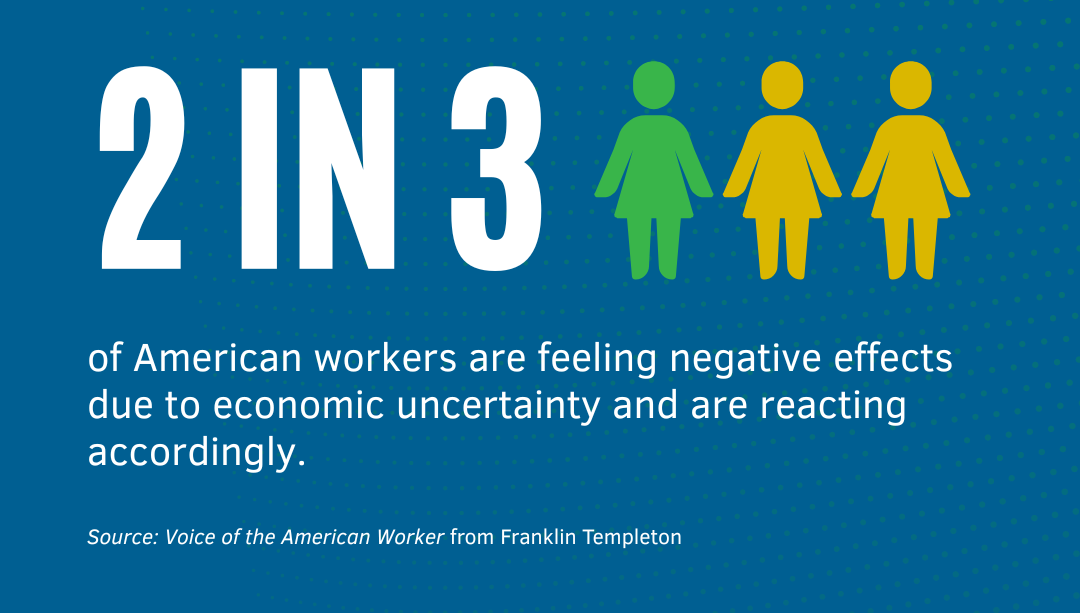

As the workplace continues to evolve, so do the expectations and needs of employees. A key trend is the move towards personalized benefits, departing from the traditional, one-size-fits-all approach. This shift aims to tailor benefits to the unique needs of each employee.