As you continue to navigate the second half of this unprecedented year, we want to provide you with an update on the most important legislative changes enacted in 2020 thus far that directly impact you and your employees. The following information will help you gauge the changes to the retirement, employee benefits, and employer-sponsored retirement plan landscape throughout this year to ensure you are aware of what you are responsible for as an employer and/or committee member. In addition to discussing the items managers and HR executives should be aware of in terms of their organizations’ employees’ well-beings, financial lives, and benefits, I’ll also shed light on the overall state of retirement in this COVID-19 environment and explain how challenges can also create opportunity for long-term investors.

As you continue to navigate the second half of this unprecedented year, we want to provide you with an update on the most important legislative changes enacted in 2020 thus far that directly impact you and your employees. The following information will help you gauge the changes to the retirement, employee benefits, and employer-sponsored retirement plan landscape throughout this year to ensure you are aware of what you are responsible for as an employer and/or committee member. In addition to discussing the items managers and HR executives should be aware of in terms of their organizations’ employees’ well-beings, financial lives, and benefits, I’ll also shed light on the overall state of retirement in this COVID-19 environment and explain how challenges can also create opportunity for long-term investors.

In a past article, I specifically discussed what to keep in mind as you administer your employer-sponsored plan in the era of the CARES Act, and since then, several additional forms of legislation and developments in past enactments have come to fruition.

Legislations and Regulations

In terms of legislative and regulatory changes, the Department of Labor (DOL) has redrafted a fiduciary rule and proposed a new prohibited transaction exemption (PTE) – a ruling by the DOL based on certain facts and circumstances that a transaction is allowable under Employee Retirement Income Security Act (ERISA) regulations – for investment advice fiduciaries. This specific rule has long been in the works within the DOL and was ultimately passed by the DOL under the prior administration during the Obama era; however, in 2017, under the new Trump administration, this rule went to circuit court and was struck down, and the DOL did not fight to uphold it. Now, the DOL is re-proposing a revised fiduciary rule in the form of an exemption that allows investment advice fiduciaries to receive a wider variety of payments and gives Americans more choices for investment advice arrangements. The DOL states that this exemption would augment the tools individuals need to make the right decisions for their financial futures, in turn protecting the retirement savings of American workers. The catch is that the DOL cut the minimum 60-day comment period in half to a mere 30 days, which lawmakers and public interest groups have balked at given the insufficient time allotted for review and response.

Additionally, the DOL proposed regulation clarifying investment duties on Environmental, Social, and Governance (ESG) investing, a rapidly growing trend in the investment world. Outside of the U.S., this trend is already quite prominent globally, and a lot of public pension funds in other parts of the world have mandates around investing in the ESG arena with metrics in place. In somewhat of a surprise proposed regulation, the DOL came out and said that investing in ESG funds can only be deemed prudent if their investment track records or long-term performance achieves equal or similar results to their non-ESG fund counterparts. Consequently, there is some dispute regarding whether or not that is within the DOL’s purview, which has sparked a debate within Congress regarding this DOL proposal.

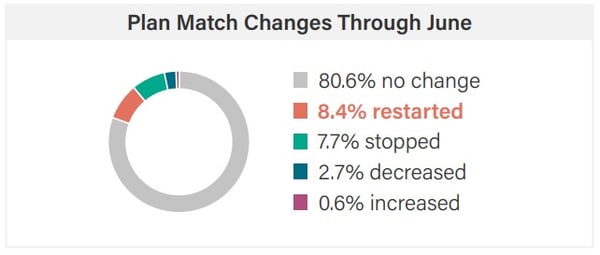

In addition to these legislative and regulatory actions, there has been some relief with respect to the pressures and financial challenges COVID has inflicted on employers and their organizations. Currently, the White House and Capitol Hill are working together on an additional stimulus package to primarily extend unemployment benefits. In unison, our industry leaders – the National Association of Plan Advisors (NAPA) and the American Retirement Association (ARA) – continue to urge elected officials to also include legislation that would provide relief to companies with respect to their 401(k) plans. What we’ve seen in the industry and through many advisors who are working with companies is that there are a lot of companies that offer safe-harbor retirement plans, meaning they are required to make a contribution match or employer contribution to their employees’ accounts, and they are on the hook for these matches and contributes due to the safe-harbor protocols. In other words, the rules in safe-harbor plans are fairly cumbersome and difficult to get out of. Furthermore, if you remove a safe-harbor provision mid-year, there are significant ramifications in doing so, and as a result, we have seen some companies and organizations completely shut down or terminate their employer-sponsored plans. From our perspective, the glaring concern with these responses is that once an organization shuts down or terminates its plan, it can be fairly difficult to put a 401(k) or 403(b) plan back in place. At the end of the day, who stands to suffer most from this – working Americans and all the employees of these organizations.

Source: Ascensus: “The State of Savings,” July 2020.

Revisiting the SECURE Act

At the end of 2019, the Setting Every Community Up for Retirement Enhancement (SECURE) Act was signed into law with the primary intention to provide greater coverage of retirement plans for workers around the country. Given the current economic and financial environment as a result of the health pandemic, there is concern that the SECURE Act could actually end up having the exact opposite impact, and there are many people in the industry who are trying to encourage the inclusion of supplemental language that provides some relief to employers. That being said, if your company is a safe-harbor plan, you need to understand what you are responsible for and required to do in terms of employee contributions into the plan because those regulations, as of now, have not changed.

There are many components of the SECURE Act that impact investments, investors, and retirement plans that companies and organizations have yet to really implement because quickly after the enactment of this Act, the country plunged into this extraordinary environment with respect to COVID-19. As a result, most retirement committees have not been able to be as strategic and proactive in terms of looking at some of these changes to rules and laws that might affect their plans within a year or a couple years from now, depending on the effective dates of the various SECURE Act provisions. With this in mind, over the second half of this year and into early 2021, it will be of the utmost importance for plan fiduciaries and retirement committees to revisit the overall provisions and governance of their plans with respect to the new laws and regulations enacted through the SECURE Act and through the potential new fiduciary and ESG rules. It is strongly advised that employers and their committees devise plans around these impending regulations that will allow you to quickly act and implement these changes, if necessary.

State of Retirement

With regards to the current retirement environment, the positive is that most investors have not made significant changes to their retirement accounts in terms of how much they are saving and investing. This adherence to long-term financial plans and retirement goals is reassuring in the retirement arena, as individuals developing strategies based on their long-term financial goals appear to be adhering to said plans despite obstacles like the COVID-19 pandemic. Additionally, the markets have fortunately rebounded fairly significantly from the preceding lows and bottom that we stomached in early March. Although there are still some asset classes and sectors underperforming and down pretty dramatically, most investors have seen a welcomingly quick recovery in their accounts, which has led them to stay invested, a strong positive to acknowledge in the current environment.

Source: Ascensus: “The State of Savings,” July 2020.

The main message for employees and investors in 401(k) plans is to recognize that there will continue to be ups and downs in the stock market along with significant volatility, and the key to success is mentally preparing for this reality and staying invested for the long term. Continuing to contribute to your retirement accounts allows you to create and reap opportunity from the attractive entry points into the markets we are seeing as a result of the underperforming sectors. We recognize that this advice may carry a gray cloud, as a number of employers have halved, reduced, or even eliminated their matching or employer contributions all together; however, this should not be a reason for individuals to stop saving in their 401(k)s. In fact, it should encourage the opposite because it makes the employees’ own contributions into their 401(k)s even more vital and important.

Hopefully, as this pandemic-ridden market cycle normalizes and we see a successful and safe return to our usual business environment, companies and organizations will be able to re-instate their full employer-matching contributions. In the meantime, it is imperative for employees to continue to save in their 401(k)s and retirement accounts to ensure they do not fall behind on their retirement savings goals.

Final Points

From a committee and an employer perspective, it is critical to continue to fulfill your fiduciary duties and have a consistent objective and process of oversight and governance over your employer-sponsored retirement plan. Although employers and their committees are inundated with other challenges and priorities with precedence over their 401(k) plans, we have continued to hold our standard review meetings with our clients, albeit virtually, to help them stay abreast of the regulatory and legislative changes within the retirement landscape and to ensure all their employees receive needed financial guidance. In our client reviews, we ensure we’ve gone through the appropriate due diligence and governance in managing the plan in conjunction with the modifying rules and regulations.

Simply because we are in an unprecedented period with countless competing priorities does not absolve a committee or organization from fulfilling its fiduciary duties. Employers and their retirement plan committees must have systems in place – and follow these systems – to uphold their duties to their companies and their employees during this period when numerous other priorities also beg attention.