The impact of financial anxiety on the American workforce has been revealed in Franklin Templeton's recent study, "Voice of the American Worker". The study highlights the challenges employees face due to the current economic climate and the importance of financial wellness in job satisfaction. Throughout the study, it exposed that this financial concern has reversed the pandemic’s “Great Resignation” to “the Great Return” and is reshaping employee benefits expectations. The study highlights that financial wellness is a critical component of job satisfaction, and employers can improve retention rates by providing their employees with the necessary financial tools and personalized solutions. To address this, employers can offer resources that enhance wellness across all dimensions - financial, physical, and mental.

The study reveals that American workers are seeking more customized and holistic options when it comes to their retirement savings behaviors. By providing such options, employers can not only improve wellness and engagement within their workforce but also demonstrate a commitment to the overall well-being of their employees. Here are some key takeaways from the study:

Two-thirds of American workers are feeling negative effects due to economic uncertainty and are reacting accordingly.

What employers can do: Employers should check in with their employees during the potential recession and offer personalized support. More American workers now want access to financial professionals as part of their employee benefits, with 58% showing interest in speaking with one.

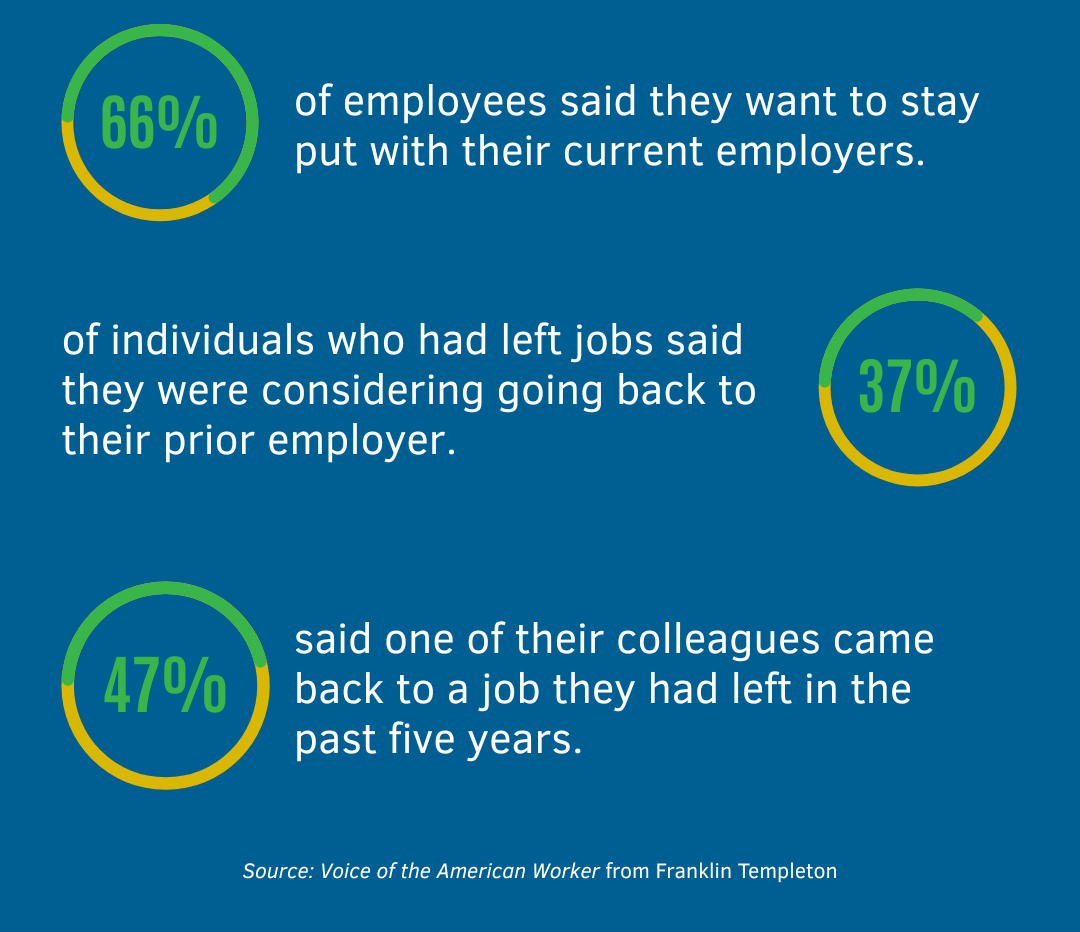

66% of employees said they want to stay put with their current employers, and on the flip side 37% of individuals who had left jobs said they were considering going back to their prior employer, and 47% said one of their colleagues came back to a job they had left in the past five years.

What employers can do: Employers should offer a more comprehensive approach to benefits and support, as it affects employee satisfaction, effort, and retention. This is particularly significant for younger generations.

70% of employees are keenly interested in more holistic benefits, meaning, this includes not only resources and tools that address retirement, but also those that support employees in all areas of their financial lives.71% said that it matters to them that their employer addresses the current economic climate.

What employers can do: More than half of employees want a pay raise to help with inflation-related stress, but they also want other benefits such as guaranteed retirement income, savings funds, education funding, and help with debt payments. Employers should consider offering alternative benefits to improve their offerings.

74% of employees stated financial independence is their top financial. In addition, 81% of respondents said they are more focused on becoming financially independent. Among other concerns, the next most important was paying off debt (61%).

What employers can do: Employers have a chance to help employees achieve financial independence by offering personalized investment options and access to financial advice. A survey found that 77% of respondents would be more likely to contribute to their retirement savings if such support was provided, including access to a financial advisor, auto-enrollment, tax guidance, budgeting, and debt guidance.

Overall, employers can play a crucial role in supporting their employees by offering customized solutions that address the full spectrum of their needs. By doing so, employers can not only improve wellness and engagement within their workforce but also demonstrate a commitment to the overall well-being of their employees. Employers who prioritize these areas could see positive outcomes in terms of employee morale, productivity, and loyalty. Feel free to reach out to our team with more questions or if you’d like to access your company’s financial wellness offerings.