3 Strategies for Assisting Employees with Debt and Financial Stress

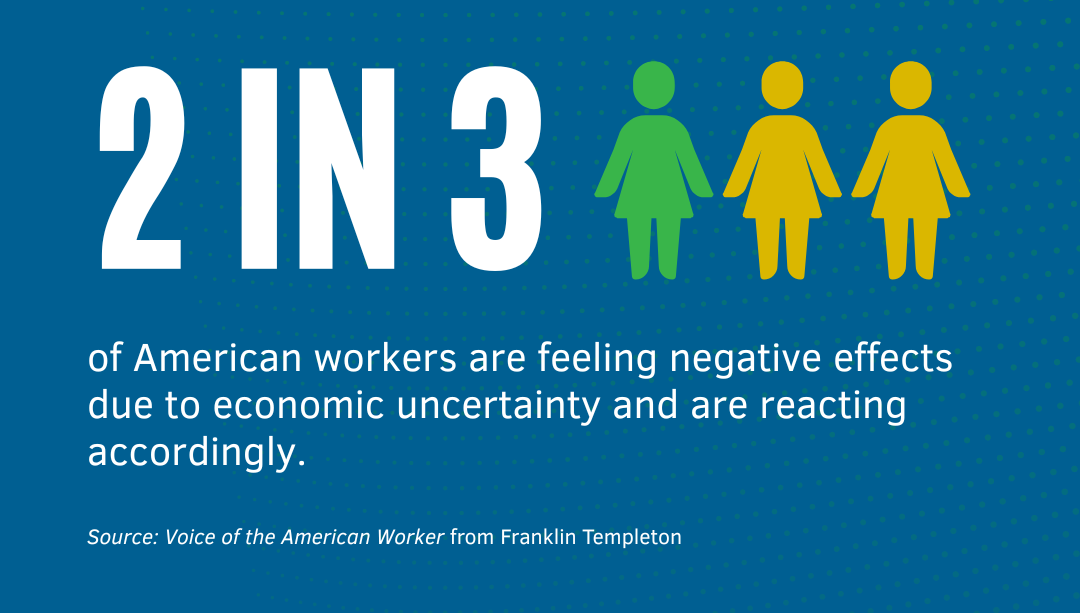

In today's society, it has become the norm rather than the exception for American workers to live paycheck to paycheck, struggling just to make ends meet. Shockingly, a third of Americans have $500 or less saved, while 8.5% have between $501 and $1,000, and 11.4% said they have no savings. This lack of financial preparation leaves them vulnerable to unexpected expenses and places them at a higher risk of financial strain.