Before dispersing for its winter break, Congress passed significant changes to retirement savings law that will affect many of us now and all of us in the future. This new law, the Setting Every Community Up for Retirement Enhancement (SECURE) Act, is part of the massive government spending bill that was approved by Congress on December 19 and signed into law by President Trump on December 20, 2019. This bill extensively reshapes the realm of employer-sponsored retirement plans for both employers and employees and enacts the biggest changes to the U.S. retirement system since 2006.

Before dispersing for its winter break, Congress passed significant changes to retirement savings law that will affect many of us now and all of us in the future. This new law, the Setting Every Community Up for Retirement Enhancement (SECURE) Act, is part of the massive government spending bill that was approved by Congress on December 19 and signed into law by President Trump on December 20, 2019. This bill extensively reshapes the realm of employer-sponsored retirement plans for both employers and employees and enacts the biggest changes to the U.S. retirement system since 2006.

The primary narrative of the SECURE Act involves the expansion of retirement plan coverage and the decrease of retirement savings hurdles to improve the current retirement outlook for many working Americans. Through this act, lawmakers seek to make it an employer’s responsibility to incentivize and encourage employees to invest in their own financial futures. The act also intends to help employers overcome the challenges involved with offering and administering a workplace retirement plan.

What the SECURE Act Means for Retirement Plan Sponsors

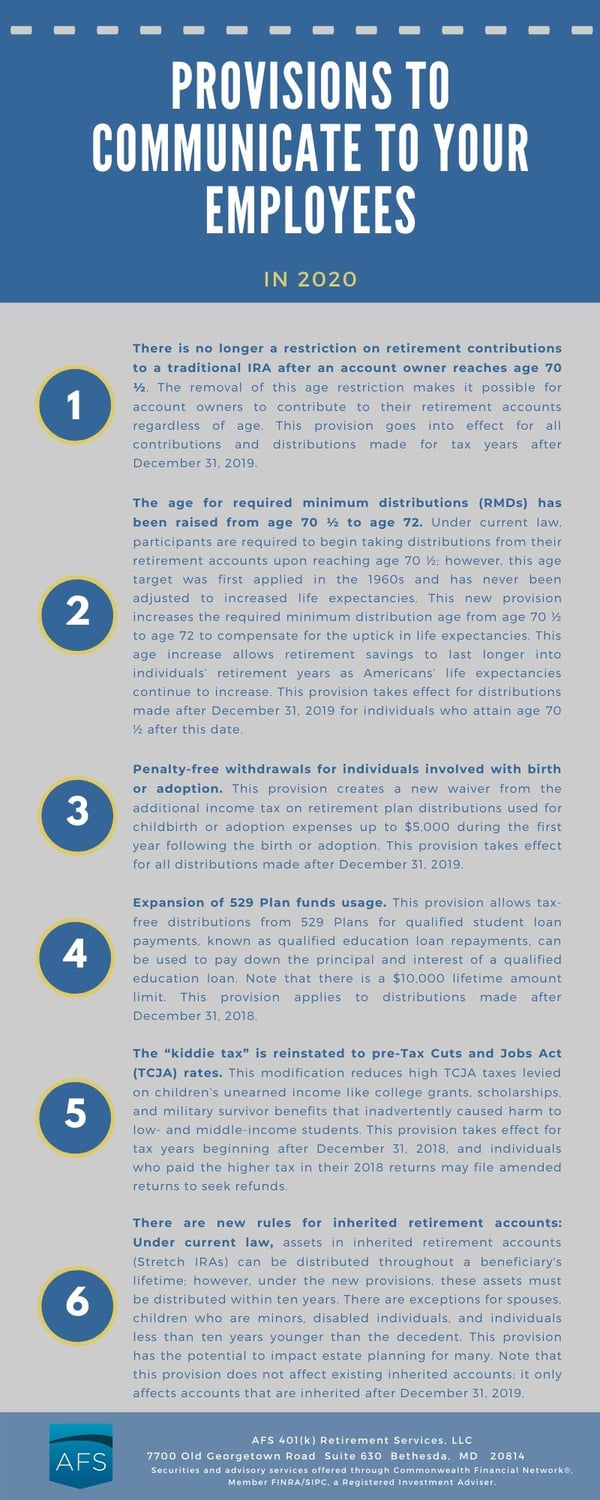

The SECURE Act comprises 29 provisions; however, not all of these provisions impact the retirement plan realm. Here is a breakdown of the changes that specifically impact retirement plans that you need to know along with each respective effective date.

- Employers are now required to allow long-term, part-time employees to participate in the retirement plan. Under current law, employers generally may exclude part-time employees (employees who work less than 1,000 hours per year) when providing a defined contribution plan to their employees. With this new provision, employers are required to maintain a 401(k) plan with a dual eligibility requirement for long-term, part-time employees that involves an employee meeting one of the following: 1) completion of one year of service that involves at least 1,000 hours worked; or 2) completion of three consecutive years of service in which the employee works at least 500 hours per year. For employees who are only eligible due to the three years of service of 500 hours, the employer may elect to exclude these employees from nondiscrimination and coverage testing and top-heavy rules. This provision takes effect for plan years beginning after December 31, 2020; 12-month periods beginning prior to January 1, 2021 will not be impacted.

- Open multiple employer plans (MEPs) are now allowed. These open MEPs permit unrelated small businesses to band together via an open retirement plan arrangement. This enables companies with smaller plans to take advantage of economies of scale and employ features that are typically only available in larger plans. There must be a designated MEP provider, and this provider must be a named fiduciary, assume responsibility as the ERISA plan administrator, register with the DOL and IRS, and must comply with the increased ERISA maximum bond amount of $1 million. Each employer involved in the MEP is expected to maintain responsibility for the selection and monitoring of the pooled plan provider and any other named fiduciary. Note that the IRS and the DOL have the authority to audit the pooled plan provider for Code and ERISA compliance. This provision goes into effect for plan years beginning after December 31, 2020.

- The IRS and DOL must require the filing of a consolidated Form 5500 for similar plans as a combined annual report for a group of plans. Plans eligible for consolidated filing must be defined contribution (DC) plans with the same trustee, fiduciary or named fiduciaries under ERISA, administrator, and the same plan year, and must provide the same investments and investment options to participants and beneficiaries. This provision aims to reduce aggregate administrative costs to make it easier for smaller employers to sponsor a retirement plan and improve retirement savings for employees. This provision shall be implemented no later than January 1, 2022 (contingent upon the IRS and DOL taking action) and will apply to all reports for plan years after December 31, 2021.

- The automatic safe harbor deferral maximum has been increased to 15%. Up from 10%, this increase raises the ceiling for employees to take advantage of automatic in-plan retirement saving. This provision takes effect for plan years beginning after December 31, 2019.

- Rules relating to election of 401(k) safe harbor status have been simplified by eliminating certain notice requirements. These eliminated notice requirements include the nonelective safe harbor 401(k) notice for plans that provide a 3% nonelective safe harbor contribution to employees. Eliminating this requirement eases the administrative burden that falls on plan sponsors when it comes to notice delivery. Note that the requirement to allow employees to make or change an election at least once per year stands in effect. Additionally, plan sponsors are permitted to switch to a safe harbor 401(k) plan with nonelective contributions at any time before the 30th day before the close of the plan year. Amendments after this time will only be allowed if the amendment provides a nonelective contribution of at least 4% of compensation (as opposed to 3%) for all eligible employees for that plan year and is amended no later than the last day for distributing excess contributions for the plan year by the close of the following plan year. This provision takes effect for plan years beginning after December 31, 2019.

- Business owners will now receive tax credits if their company offers an automatic enrollment provision for their employees in 401(k) and Simple individual retirement account (IRA) plans. This provision creates a new tax credit for up to $500 per year to employers to defray startup costs for new 401(k) plans and SIMPLE IRA plans that include automatic enrollment. This credit is in addition to the plan startup credit allowed under current law and is available for three years. The credit is also available to employers that convert an existing plan to an automatic enrollment structure. This change incentivizes business owners and organizations to make saving for retirement easier for employees. This provision takes effect for all tax years beginning after December 31, 2019.

- Lifetime income projections will be required to appear on plan participant benefit statements. This provision requires benefit statements provided to defined contribution (DC) plan participants to include a lifetime income disclosure at least once during any 12-month period. This added disclosure provides employees a clearer picture of their retirement savings progress to help them get or stay on track to adequately save for retirement. This disclosure will illustrate the monthly payments the participant would receive if his or her total account balance were used to provide lifetime income streams. Note that plan fiduciaries and plan sponsors will not be liable under ERISA for the lifetime income stream equivalents that are derived in the disclosure. The Department of Labor (DOL) is set to develop a model disclosure, and this provision takes effect for pension benefit statements supplied more than 12 months after the DOL issues the final guidelines and disclosure.

- Plans adopted by the filing due date for the year may be treated as effective as of close of the year. This provision permits businesses to treat qualified retirement plans adopted before the due date, including extensions, of the tax return for the taxable year to treat the plan as having been adopted as of the last day of the taxable year. This additional time to establish a plan provides flexibility for employers considering adopting a plan and the opportunity for employees to receive contributions for the earlier year to begin accumulating retirement savings immediately. This provision takes effect for plans adopted for tax years beginning after December 31, 2019.

- There are modified nondiscrimination rules to protect older, longer service participants. This provision provides nondiscrimination testing relief for employers with defined benefit plans that are closed to new entrants. The nondiscrimination testing relief includes benefits, rights and features, and benefit accrual relief for closed participants and minimum participation requirement relief. This provision took effect upon enactment on December 20, 2019, without regard of when the plans are modified.

- 403(b) Custodial Accounts under terminated plans may be distributed in kind. Under this provision, the Treasury must issue guidance that an individual 403(b) custodial account can be distributed in kind to the participant or his or her beneficiary if the employer terminates the 403(b) custodial account. The individual custodial account will be maintained on a tax-deferred basis as a 403(b) custodial account until it is paid out, and it will be subject to the 403(b) rules in effect at the time the individual custodial account is distributed. It is important to note that this Treasury guidance will be retroactively effective for taxable years beginning after December 31, 2008.

- Lifetime income options are portable. This change allows qualified DC plans, 403(b) plans, and governmental 457(b) plans to make a direct trustee-to-trustee transfer to another employer-sponsor retirement plan or IRA. This transfer can be of lifetime income investments or distributions of lifetime income investments in the form of a qualified plan distribution annuity if a lifetime income investment is no longer available as an investment option under the plan. This provision takes effect for plan years beginning after December 31, 2019.

Conclusion and Next Steps

A majority of the provisions within the SECURE Act go into effect on January 1, 2020; however, there are exceptions that have been noted. Additionally, due to the proximity of the act’s passage date to its effective date, a remedial amendment period clause permits employers to make changes to their company plans by the 2022 plan year and even by the 2024 plan year for a few select governmental plans. This clause eases the administrative burden on employers when it comes to complying with the new law.

It is clear that lawmakers are focused on improving and fortifying the American retirement system via increased and easier access to retirement savings vehicles, especially workplace retirement plans. To prepare for the SECURE Act’s impact on your company’s retirement plan, review your plan’s provisions and features with your third-party administrator, service provides, and plan sponsor. Additionally, ensure that you properly determine which plan amendments are required and what enhancements need to be made to set your company’s retirement plan up for success with these monumental legislative changes.

For questions or clarifications, please contact Alex Assaley (aassaley@afs401k.com) at (301) 961-8401.