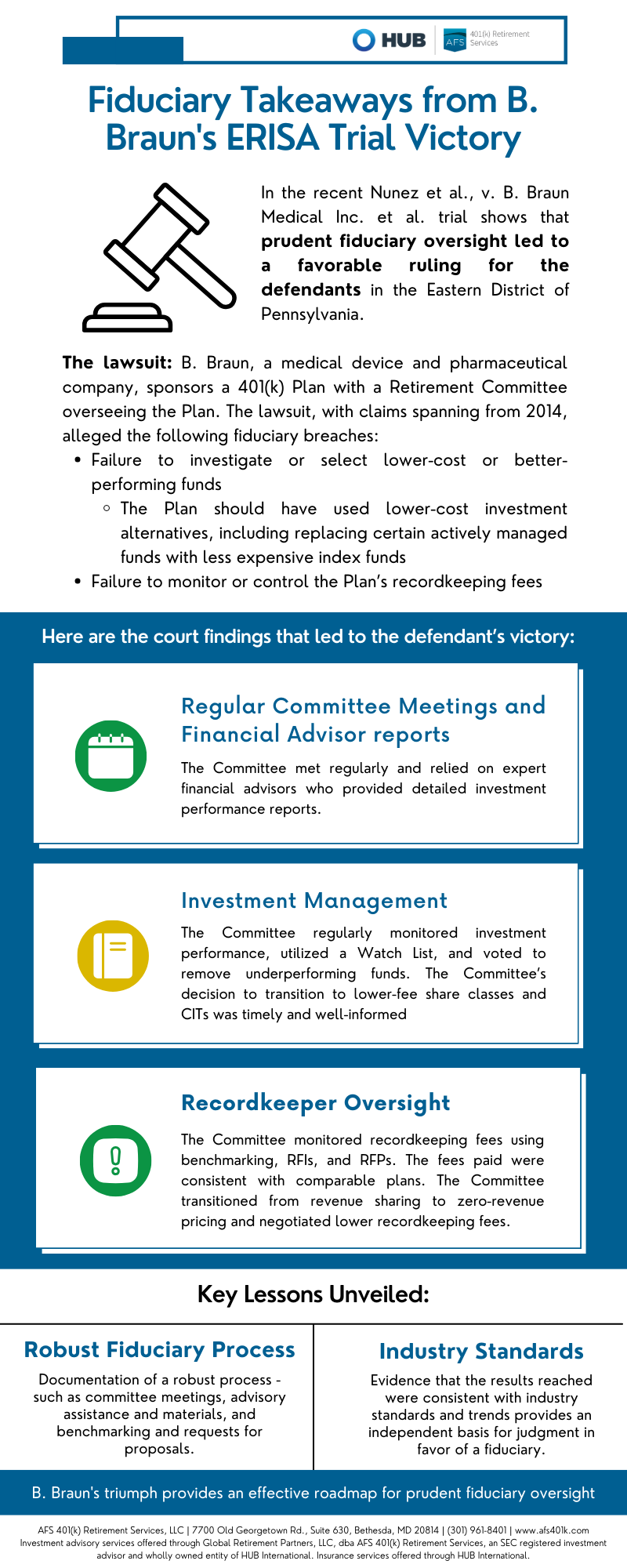

Navigating the complexities of ERISA fiduciary claims and managing a retirement plan can be challenging. There's one recent case that's making waves – the Nunez et al., v. B. Braun Medical Inc. et al. saga. This 63,000-member class action accused B. Braun and its retirement committee of breaching ERISA's fiduciary duties. After a three-day bench trial, the Eastern District of Pennsylvania ruled in favor of B. Braun on all fronts. This victory marks a game-changer in the 401(k) landscape, especially when it comes to investments and recordkeeping fees.

Let's dig into the backstory:

Braun, a player in the medical device and pharmaceutical scene, runs a 401(k) plan with a committee overseeing investments, monitoring, and recordkeeping. The lawsuit, spanning from 2014 to the present, zoomed in on claims of fiduciary duty breaches related to investment choices and recordkeeping fees.

Now, here are the trial highlights that sealed the deal for B. Braun:

1. Regular Committee Meetings: B. Braun's committee met regularly, demonstrating a commitment to prudent practices.

2. Financial Advisor Reports: They relied on detailed performance reports from their financial advisors, ensuring informed decision-making.

3. Investment Monitoring: Proactive monitoring of investment performance and a swift response to underperforming funds.

4. Transition to Lower-Cost Options: An informed decision to transition to lower-fee share classes and collective investment trusts (CITs).

5. Recordkeeping Fee Prudence: Negotiating and monitoring recordkeeping fees through benchmarking studies and transitioning away from revenue-sharing investments.

Lessons Learned:

1. Process, process, process: Establishing and documenting a robust process with regular committee meetings, advisory support, fee benchmarking, and investment actions craft a story of prudence.

2. Playing by the (industry) rulebook: Achieving results aligned with industry standards and trends makes your case easier to compare for non-experts (judges and juries).

3. Ensure you have appropriate insurance coverage: We recommend organizations and their Committees obtain appropriate levels of Fiduciary Liability Insurance, Cyber and Data-security insurance, and other types of professional liability insurance to help manage risk and, in the event of litigation, provide cost containment to defend your organization.

Lawsuits like this serve as a reminder of the valuable work you're already doing for your employees and reinforce our commitment to simplifying complex retirement plans. We are here to support you every step of the way. If you have any questions or would like to discuss your fiduciary risk further, please do not hesitate to reach out.