It's no secret that financial literacy is not a strong skill for many Americans. In a recent study, it was noted that nearly two-thirds of adults couldn't pass a basic financial literacy test. That fact is not too surprising when you consider that currently, only 4 states require students to take a personal finance class in order to graduate. With rising student loan debt, increases in the cost of living, and medical costs continuing their upward trajectory, how can we get a handle on our financial lives?

Recently, employers have been positioning Financial Wellness benefits as the answer for employees. Much like health-focused wellness benefits that have become popular, financial wellness takes the same basic premise and uses it to help employees learn about things such as budgeting, managing debt, and saving for their future.

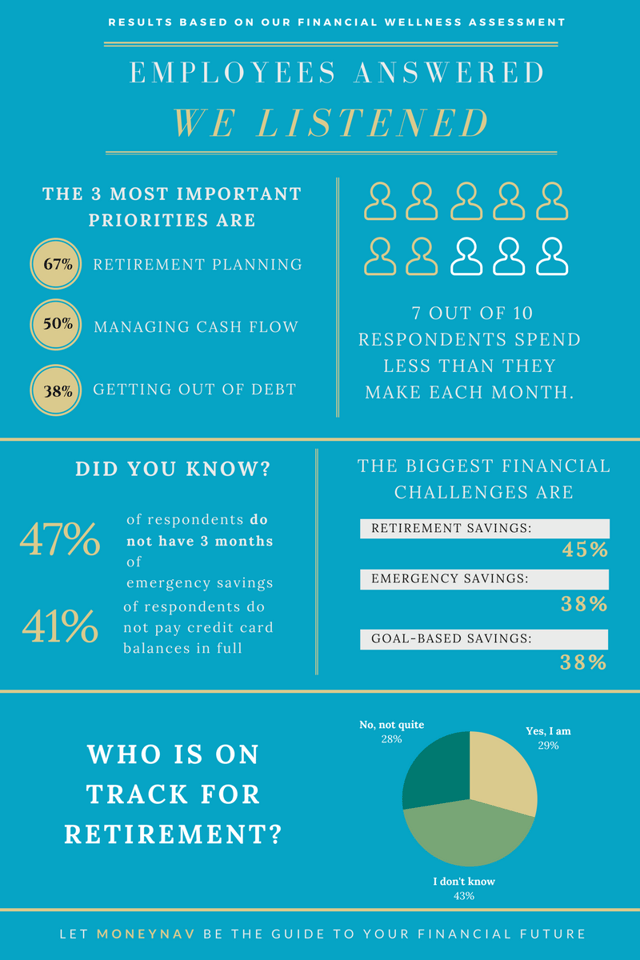

While Financial Wellness programs are gaining popularity, information is lacking when it comes to 1) whether employees really need these programs; and 2) measuring the positive results these benefits can deliver. This is why we conducted our 2016 Financial Wellness Assessment, surveying more than 500 employees about their financial lives, goals, and problems, in order to find out how financial guidance, or the lack thereof, might be impacting them.

Here's a snapshot of what we discovered:

- 70% of the surveyed employees are not comfortable with their current debt situation.

- 36% are struggling to pay off student loan debt.

- 45% stated they do not have a handle on their cash flow.

Whether it's not having an emergency fund, slacking on retirement savings, trying to manage credit card debt, or just figuring out how to balance a basic budget, more often than not people need some help. This becomes even more important when you consider how much time, effort, and resources are put into helping people participate in employer-sponsored retirement plans.

This begs the question: If employees are saving for retirement in their 401(k) plans, but they lack other basic money management skills, will it even matter? Will they be able to retire "successfully"?

To answer this and other questions, we spent 2016 performing extensive research which has produced our 2017 report, Beyond Retirement: An Examination of Financial Wellness for Employers. It dives deeper into developing a clear picture of what an average working American's financial situation looks like and how this may impact their ability to reach goals throughout their career and lifetime. Plus, our analysis examines three case studies of specific organizations who have implemented Financial Wellness programs and the positive impact these programs have had on metrics such as retirement plan participation, savings rates, and much more.

This guide also provides some step-by-step actions you can begin taking right now in order to implement your organization's Financial Wellness benefits to employees.

Want to see the full report?

Download Beyond Retirement: An Examination of Financial Wellness for Employers below: