Are Health Savings Accounts the Key to Employees' Retirement?

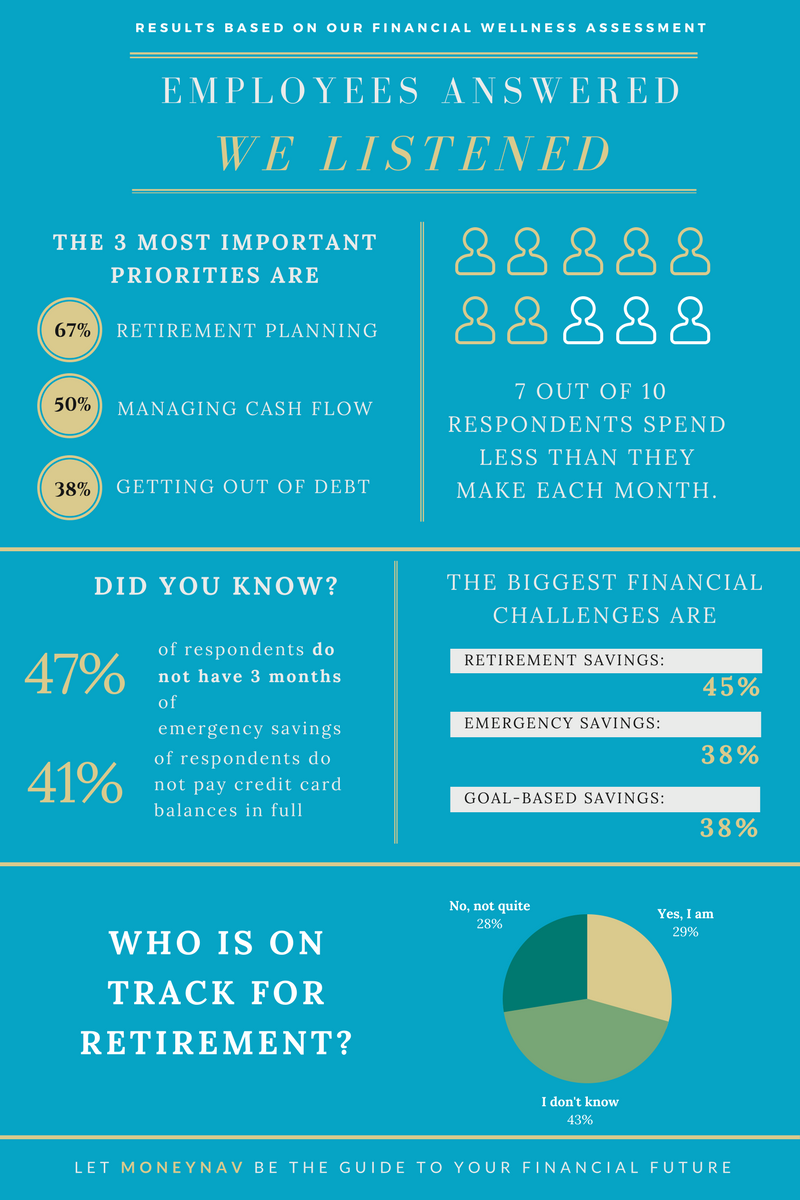

Employer retirement plans of all kinds, including 401(k)s, have increasingly become seen as the holy grail in the world of retirement benefits. If employers offer a retirement plan (especially if there's a match), then employees will save, and they will be able to happily retire when they want...or at least that's the intent. Overall, while there are many reasons that Americans struggle with saving enough for retirement, even if they have access to a plan through work, there is another benefit that can provide an extra boost from employers: Health Savings Accounts.